Introduction

Managing personal finances has become more important than ever in 2025. With rising living costs and more digital payments, people need smarter tools to track expenses, control budgets, and plan for the future.

Personal finance apps simplify money management by offering real-time insights, automated tracking, and goal-based saving features.

Below are three of the most reliable and widely used personal finance apps that help users build better financial habits.

1. Mint – Complete Overview of Your Finances

Mint is one of the most well-known personal finance apps, trusted by millions of users worldwide.

Key features

- Automatic tracking of income and expenses

- Custom budget creation by category

- Alerts for unusual spending

- Monthly financial reports and charts

Why it’s effective

Mint gives users a clear snapshot of their financial health at any moment. By visualizing spending patterns, it becomes easier to cut unnecessary costs and save more money.

Best for: Beginners who want an easy-to-use budgeting app.

2. YNAB (You Need A Budget) – Budget with Purpose

YNAB focuses on proactive budgeting, encouraging users to assign every dollar a job.

What makes YNAB different

- Zero-based budgeting system

- Real-time syncing across devices

- Goal tracking for savings and debt payoff

- Educational content to improve money habits

Why users love it

YNAB helps users change how they think about money. Instead of tracking past spending, it guides future financial decisions.

Best for: Users serious about budgeting and long-term financial planning.

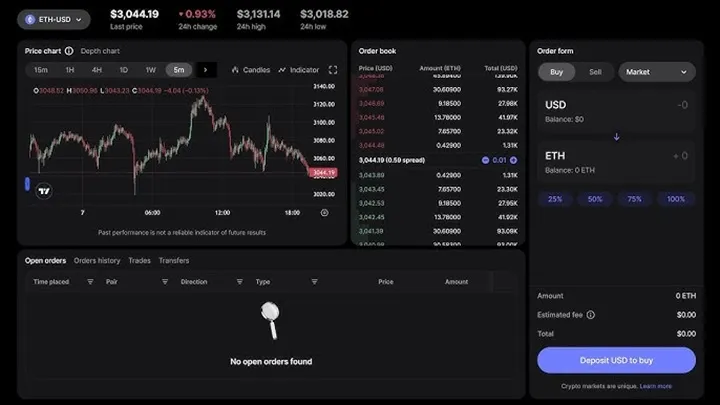

3. Revolut – Smart Digital Banking and Money Management

Revolut combines banking, spending analytics, and savings features in one powerful app.

Core benefits

- Real-time spending insights

- Multi-currency accounts and low exchange fees

- Savings vaults with automatic transfers

- Built-in investment and crypto features

Why it stands out

Revolut is more than a finance app — it’s a complete digital money platform that fits modern lifestyles.

Best for: Travelers, online shoppers, and users who want flexible digital banking.

Conclusion

These three personal finance apps — Mint, YNAB, and Revolut — offer powerful tools to help users save money, control spending, and plan for the future in 2025.

Whether you’re just starting your financial journey or looking to optimize your money habits, these apps make financial management simpler and more effective.